Disclosure Policy

1. Basic Disclosure Policy

COPRO-HOLDINGS. Co., Ltd. (hereinafter the “Company”) discloses information in accordance with the Companies Act, the Financial Instruments and Exchange Act, other laws and regulations, and the Tokyo Stock Exchange Rules on Timely Disclosure of Corporate Information by Issuers of Listed Securities (hereinafter the “Timely Disclosure Rules”). In case of any decisions and events that may influence investor decisions, the Company discloses information in accordance with the Timely Disclosure Rules. The Company also discloses information that is not required by the Timely Disclosure Rules but that it believes will be useful for investment decisions.

2.Information Disclosure Means

This policy covers information disclosure by the following means.

1. Statutory disclosure

(1) Disclosure under the Financial Instruments and Exchange Act

Securities reports, quarterly reports, internal control reports, extraordinary reports, etc.

(2) Disclosure under Company Law

Business reports, financial statements, consolidated financial statements, etc.

2. Disclosure required by Tokyo Stock Exchange

(1) Timely disclosure (decision facts, occurrence facts, financial Information, etc.), financial results, quarterly financial results

(2) Corporate Governance Report

3. Other information disclosure

(1) IR related disclosure materials (results briefing materials, etc.)

(2) Briefing sessions for individual investors, etc.

(3) General Meeting of Shareholders notices, shareholder communications, etc.

(4) News releases, materials posted on our website, and other voluntary disclosure materials

3. Fair Disclosure Initiatives

The Company complies with the Fair Disclosure Rules and manages material non-public information that may significantly influence investor decisions. When communicating such information externally, the Company makes efforts to fairly disclose it to prevent selective disclosure.

4. Disclosure Method

The Company discloses information that is subject to the Financial Instruments and Exchange Act, using Electronic Disclosure for Investors’ NETwork (EDINET) provided by the Financial Services Agency.

The Company discloses information that is subject to the Timely Disclosure Rules, using the Timely Disclosure network (TDnet) provided by the Tokyo Stock Exchange.

The Company also endeavors to disclose other material information through TDnet as appropriate as well as swiftly posting it on the Company’s website.

5. Prevention of Insider Trading

In order to prevent insider trading, the Company established internal rules that stipulate appropriate management of material information, share trading, and other matters that must be complied with. It strives to make all employees and officers of the Group fully aware of the rules and to enlighten them about the rules.

6. Handling of Business Performance Forecasts and Future Information

The Company discloses business performance forecasts, strategies, policies, goals, etc. Such disclosed information that is not historical facts represents forward-looking statements prepared based on information available to the Company at the time and on plans, expectations, and decisions made based on certain assumptions that it deems reasonable. Actual results may differ significantly from those discussed in the forward-looking statements due to various risks and uncertainties.

7. Quiet Period

To prevent the leakage of earnings results and ensure fairness, the Company designates a quiet period from the day following the end of a quarter until the announcement of financial results for that quarter. During the quiet period, the Company will make no comments and answer no questions about earnings results except for ones that are related to already disclosed information. However, the Company will disclose information that is subject to laws and regulations and the Timely Disclosure Rules in a timely and appropriate manner even during the quiet period.

8. Spokesperson for IR Activities

We designate the CEO and the officer in charge of IR operations as spokespersons to communicate with our investors. The aim of this is to ensure the accuracy of information and fairness of disclosures in our IR activities. In principle, our other officers do not communicate with investors. This is to ensure consistency of disclosures and to avoid selective disclosures. However, if our other officers do communicate with investors, they will do so within the scope approved by the spokespersons each time.

9. IR Activities

| Supplementary information individual investors | We hold briefings for individual investors and participate in events (e.g., IR fairs) organized by securities companies. |

| Supplementary information analysts and institutional investors | We periodically hold second quarter and full-year financial briefings. We also visit institutional investors and give individual interviews with them. |

| Supplementary information website | We have set up and post to a section dedicated to IR on our website. |

| Supplementary information IR divisions | We have established the Corporate Planning Office. |

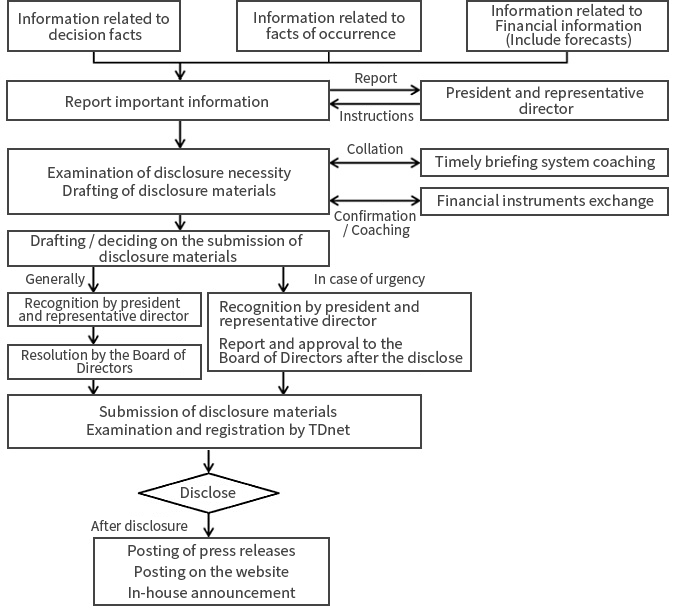

10. Timely Disclosure Structure Overview (Schematic Diagram)