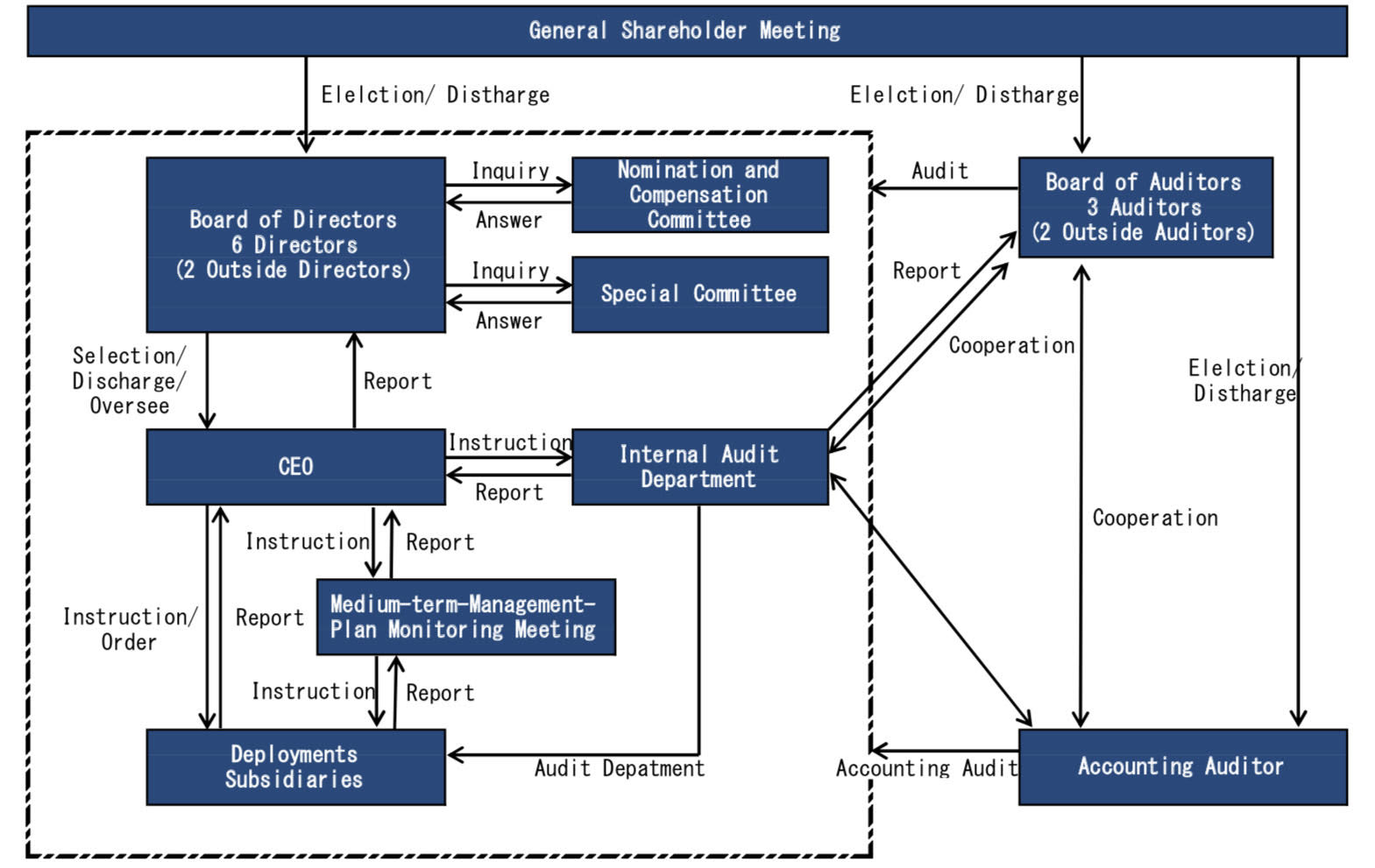

Corporate Governance Structures

Organizational Composition and Operation

| Organization Form | Company with a Board of Auditors |

Directors

| Maximum Number of Directors Stipulated in Articles of Incorporation | 10 |

| Term of Office Stipulated in Articles of Incorporation | 2 years |

| Chairperson of the Board | CEO |

| Number of Directors | 5 |

| Number of Outside Directors | 2 |

| Number of Outside Directors Who are Independent Directors | 2 |

Board of Auditors

| Establishment of Board of Auditors | Established |

| Maximum Number of Auditors Stipulated in Articles of Incorporation | 4 |

| Number of Auditors | 3 |

Outside Directors

Name |

Attribute |

Designation as Independent Director |

Supplementary Explanation of the Relationship |

| Norio Hayama | From another company |

○ |

- |

| Masashi Fujimaki | From another company |

○ |

- |

Reasons of Appointment

Name |

Reasons of Appointment |

| Norio Hayama - Inauguration in June 2018 - Attendance of Board of Directors meetings: |

Norio Hayama is a certified Labor and Social Security Attorney and possesses expertise and an extensive record in labor relations. We expect Mr. Hayama to provide valuable advice on management of the Company and have appointed him as an outside director. He also fulfills the requirements for independence specified by Tokyo Stock Exchange, Inc. We have determined that he does not pose the risk of conflicts of interests with general shareholders and have designated him as an independent officer. |

| Masashi Fujimaki - Inauguration in June 2020 |

Masashi Fujimaki possesses extensive experience and insight as a manager. We expect him to provide advice on supervision of the performance of duties and other matters based on his experience and have appointed him as an outside director. He also fulfills the requirements for independence specified by Tokyo Stock Exchange, Inc. We have determined that he does not pose the risk of conflicts of interests with general shareholders and have designated him as an independent officer. |

Outside Auditors

Name |

Attribute |

Designation as Independent Officer |

Supplementary Explanation of the Relationship |

| Manabu Haruma | Attorney |

○ |

- |

| Atsushi Okura | Certified Public Accountant (CPA) |

○ |

Atsushi Okura worked at KPMG AZSA LLC. COPRO-HOLDINGS. Co., Ltd. retains KPMG AZSA LLC as its accounting auditor; however, the audit agreement was concluded in September 2016 and Atsushi Okura was not involved in the corporate audit of COPRO-HOLDINGS. Co., Ltd. while he worked at KPMG AZSA LLC. Mr. Okura does not have any other personal, capital, or material transactional relationships with COPRO-HOLDINGS. Co., Ltd. |

Reasons of Appointment

Name |

Reasons of Appointment |

| Manabu Haruma - Inauguration in February 2017 - Attendance in FY2023 ・Board of Directors meetings: 15/15 (100%) ・Board of Corporate Auditors: 14/14 (100%) |

Manabu Haruma is a licensed attorney and possesses expertise in corporate law. We have judged him capable of fulfilling impartial management supervisory functions by performing audits based on his expertise and have appointed him as an outside auditor. He also fulfills the requirements for independence specified by Tokyo Stock Exchange, Inc. We have determined that he does not pose the risk of conflicts of interests with general shareholders and have designated him as an independent officer. |

| Atsushi Okura - Inauguration in March 2017 - Attendance in FY2023 ・Board of Directors meetings: 15/15 (100%) ・Board of Corporate Auditors: 14/14 (100%) |

Atsushi Okura is a Certified Public Accountant (CPA) and licensed tax accountant, and possesses expertise in corporate finance and other areas. We have judged him capable of fulfilling impartial management supervisory functions by performing audits based on his expertise and have appointed him as an outside auditor. He also fulfills the requirements for independence specified by Tokyo Stock Exchange, Inc. We have determined that he does not pose the risk of conflicts of interests with general shareholders and have designated him as an independent officer. |

Supporting System for Outside Directors and/or Auditors

The Management Strategy Division distributes materials pertaining to the agenda items for Board of Directors meetings far enough in advance to allow time to consider the materials. When necessary, the Management Strategy Division also provides explanations in advance. The full-time auditor also provides the information shared among Board of Auditors audits, accounting audits, and internal audits to outside auditors.

Director Compensation

Disclosure of Policy on Determining Compensation Amounts and Calculation Methods

The Company specifies the maximum limit of compensation for directors and auditors at the General Meeting of Shareholders. Annual officer compensation, including officers’ bonuses, and other compensation paid are kept within that maximum limit.

Maximum limit on officer compensation (in one fiscal year):

500 million yen for directors (resolution passed at the extraordinary General Meeting of Shareholders held on March 31, 2017)

30 million yen for auditors (resolution passed at the extraordinary General Meeting of Shareholders held on February 24, 2017)

At the annual General Meeting of Shareholders held on June 24, 2020, the maximum total amount of monetary compensation rights was set at 50 million yen a year, with the introduction a restricted stock compensation system. This amount is a part of the maximum limit on officer compensation noted above.

The total number of common shares of the Company issued or distributed under this system was set at a maximum of 50,000 shares per year (if circumstances arise that necessitate a stock split or reverse stock split for common shares of the Company, the Company may make reasonable adjustments to the number of shares issued or distributed).

The following policy on decisions concerning the individual compensation of directors was approved at the Board of Directors meetings held on February 10, 2021 and on April 13, 2022:

a.Policy on Decisions Concerning Officer Compensation

The Company’s policy on decisions concerning officer compensation is as follows:

1.Compensation shall function as an incentive for ongoing enhancement of corporate value and improvement in performance, and value will be shared with shareholders.

2.The level of compensation shall be commensurate with the role and responsibilities of the officer and a level that can attract and retain outstanding human resources.

3.Compensation shall focus on transparency that will achieve accountability and fairness.

b.Process for Determining Officer Compensation and Type of Compensation

The Board of Directors established the Nomination and Compensation Committeee as an advisory body to ensure transparency and fairness of the decision-making process concerning officer compensation. T

Specific compensation amounts are calculated based on Company-specified rules, within the maximum limit on compensation approved by the General Meeting of Shareholders. After the Nomination and Compensation Committee deliberates and reports, director compensation is discussed by the Board of Directors. The compensation of auditors is discussed by the Board of Auditors.

c.Composition of Compensation by Position

Directors (excluding outside directors)

・Compensation consists of a base salary, performance-linked compensation, and restricted stock compensation.

・If the goals for performance-linked compensation are met, the system is designed so that compensation theoretically consists of roughly 60% base salary and 40% from performance-linked and restricted stock compensation combined.

Outside Directors

・Outside directors only receive a base salary and no performance-linked compensation is paid, to preserve independence.

Auditors

・Auditors only receive a base salary, out of consideration for the fact that they perform legal compliance audits.

d.Compensation System

Types of Compensation |

Payment Method: Fixed/Variable |

Details of Compensation, etc. |

| Fixed Compensation | Fixed Compensation, Cash | ・The level of compensation shall take economic conditions, the Company’s growth potential, and other relevant factors into consideration. ・Fixed compensation shall be paid according to the role and responsibilities. |

| Performance-Linked Compensation | Variable Compensation (Annual), Cash | ・Consolidated profit attributable to owners of parent has been established as the indicator to more clearly link the responsibility for achieving company-wide performance each year to compensation, as an element that enhances corporate value and increases the stock price. ・The theoretical total amount of compensation is calculated based on consolidated profit attributable to owners of parent. This is allocated according to position, and the resulting amount is multiplied by a coefficient that takes into account the performance evaluation of the organization the individual is in charge of, the evaluation of the individual’s strategic actions, and contributions to the governance system, among other factors, to determine the amount of individual compensation. The theoretical total amount of compensation is 8% ofconsolidated profit attributable to owners of parent for the fiscal year, and the performance-linked coefficient range is 0.7 to 1.3. * Calculation formula Performance-linked compensation = {(consolidated profit attributable to owners of parent x 8%) × the position percentage specified in the Company’s compensation guidelines} × the performance evaluation coefficient specified in the Company’s compensation guidelines |

| Restricted Stock Compensation | Variable Compensation (Medium/Long-Term), Non-Monetary | ・Restricted stock compensation was introduced as an incentive to improve corporate value over the medium and long term by enabling directors to share value with shareholders and raise directors’ awareness of the stock price. |

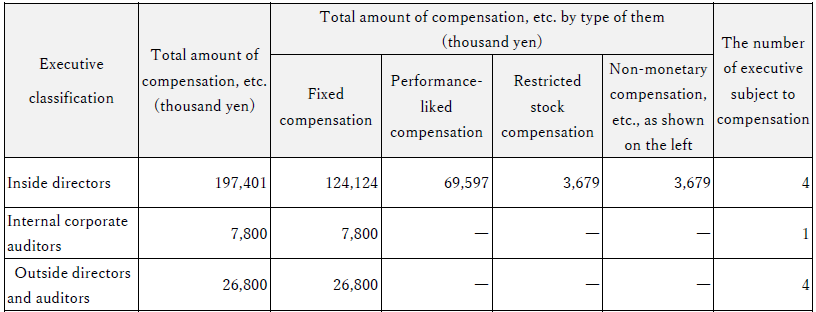

Total Amount of Compensation, etc. by Executive Classification and by Type of Compensation, etc., and the Number of Executive Subject to it.

*Note: Performance-linked compensation includes annual compensation determined by resolution of the Board of Directors meeting held on June 24, 2020 and that held on June 24, 2021, for the current fiscal year.

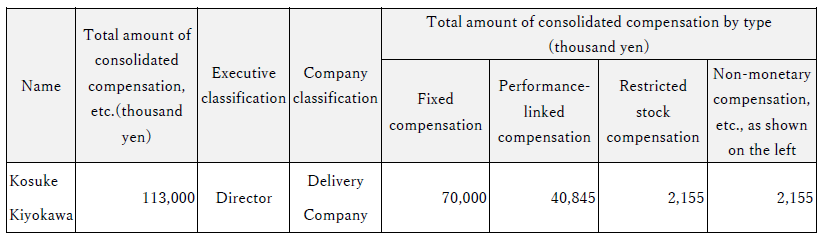

Total Amount of Consolidated Compensation, etc. by Director

*Note:

1. The figures are limited to those whose total amount of consolidated compensation, etc. is 100 million yen or more.

2. Performance-linked compensation includes the annual compensation decided by the resolution of the Board of Directors meeting held on June 24, 2020, and that held on June 24, 2021, for the current consolidated fiscal year.

Cross-Shareholdings

The Company does not have any cross-shareholdings at present.

Pattern Diagram

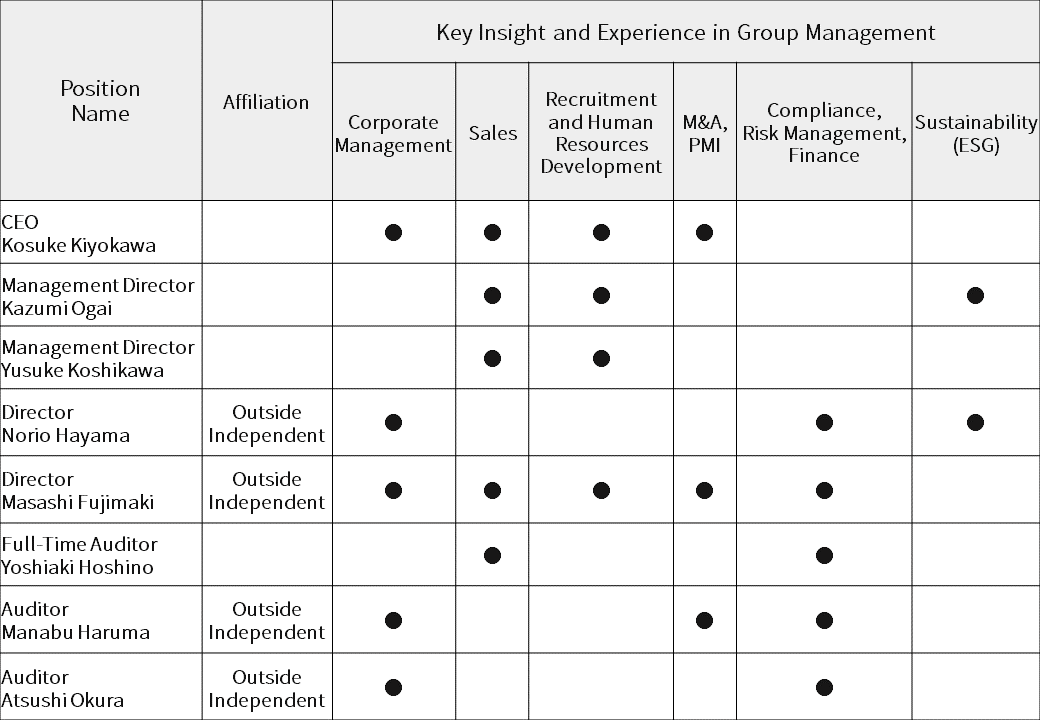

Key Insights and Experience of the Board of Directors

| Key Insights and Experience | Reasons for the Skills Selection | Relevance to the Business Strategy |

| Corporate Management | To improve profitability through business restructuring and strengthen governance structure | Overall management strategy |

| Sales | To strengthen our business with industry experience and knowledge | Strengthening core business, and DX investment |

| Recruitment and Human Resources Development |

To strengthen recruitment, training, and utilization of human resources | Strengthening core businesses, and human capital management |

| M&A, PMI | To accelerate business expansion through M&A (Noted as an important strategy in the medium-term management plan) | Complementation of core business, creating group synergies / Strengthening core businesses, and creating group synergies |

| Compliance, Risk Management, and Finance |

To support stable business operations and group growth | Strengthening management base |

| Sustainability(ESG) | To build a highly sustainable business model | Sustainability management |

Board Skills Matrix